Two trillion euros to invest in infrastructure by 2020. This is the amount that the European Commission calculates is needed to support economic growth among the European Union’s member states. It is practically an impossible target without the support of private investors, whether they be venture capitalists, private equity firms or institutional investors.

According to the 2016 report “Europe’s Economic Foundations: Investing in Infrastructure” published by Invest Europe, an association based in Brussels that represents these investors, funds that are specialized in infrastructure would have €167 billion to invest. «European infrastructure requires an investment of 3.6% of GDP to keep our economy growing,» says Invest Europe Chief Executive Michael Collins in the report. «At a time when public expenditure is under strain, private infrastructure investors help to bridge the funding gap, offering a vital source of capital and expertise.»

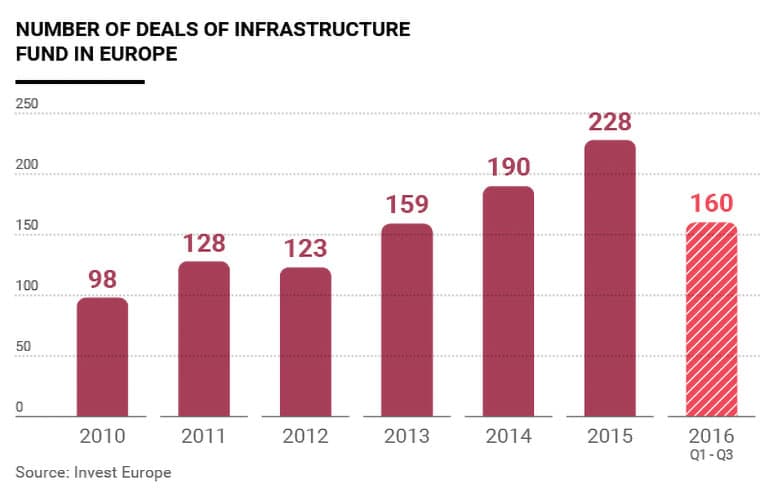

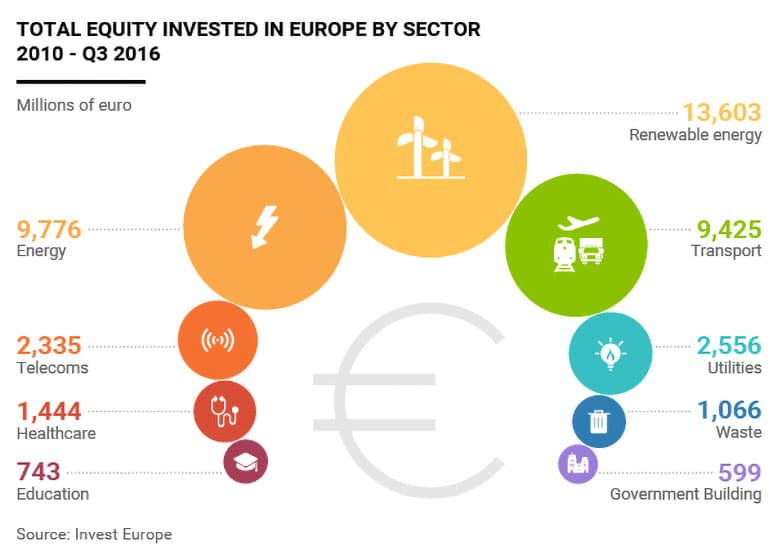

Looking at the role of private investors in the sector, Invest Europe calculated the investments made from 2010 to the third quarter of 2016. The total reached €39 billion. On renewable energy they were €13.6 billion; energy, €9.7 billion; transport, €9.4 billion; utilities, €2.5 billion; telecommunications, €2.3 billion; health, €1.4 billion; waste, €1 billion; education, €734 million; and public buildings, €599 million. But EU institutions want to involve them even more by offering them investment guarantees and making the market more attractive.

The Juncker plan: €240 billion by 2017

The debt crisis that has convulsed the EU since the 2008 financial crisis has led to a significant reduction of public investment in infrastructure. From 2010 to 2013, the most difficult years of the crisis, investments made by the bloc’s 28 member states fell 11%. And it happened just as the region’s infrastructure was in need of fresh funds.

This led to the European Commission and the European Investment Bank (EIB) to launch in 2014 the European Fund for Strategic Investment (EFSI). Also known as the Juncker Plan, it is a financial vehicle that became operative in 2015, thanks to a public injection of €21 billion. Its role is to guarantee investments made by private investors in the sector.

By last summer, the fund had overseen €100 billion worth of investments, representing 37% of the €315 billion target that the Commission aims to reach by the end of 2017, €240 billion of which for infrastructure projects.

Encouraged by the fund’s success, the Commission and the EIB recently provided more money to the fund, bringing their total contribution from €21 billion to €33.5 billion.

Beyond 2017, they have set a target for 2020, hoping to bring the accumulated total amount of funds invested to €500 billion.

Deloitte: an interesting return for investors

In a report entitled “European Infrastructure Investors Survey 2016”, consultancy Deloitte published the results of a survey it conducted with private investors about the opportunities seen in the EU bloc. Some 90% of the investors interviewed described as resilient their investments in infrastructure, while cash yield was as high. About 70% said return was between 5-7%; 10% said it was 7-9%; 10% said it was 9-11%; 5% said it was 11-13%; while another 5% said it was at less than 5%.

Deloitte also looked at the type of infrastructure that provided the best performance for investors. First were the airports, which nearly 50% of investors said was particularly good. Then, by order of importance, there was the hydraulic sector, railways and metros, and finally renewable energy.

What’s more, the involvement of these investors in the infrastructure projects was more direct than simply buying bonds issued by a public entity to finance a public work. About 95% of those polled defined their involvement as active. But their participation was not so much technical as it was financial and strategic, helping draft business plans, for example.

The element of risk was also considered. The report shows how 38% of investors surveyed cited political risk as the first to be assessed; 35% cited regulatory risk; 15% operational risk; 7% tax risk and 5% project refinancing.

The interest of insurers

Big insurance companies are also joining, according to Insurance Europe, an industry association based in Brussels. In a report published in December, they are interested in making short-term investments in infrastructure to the tune of at least €50 billion in total. The reason is their need to diversify their investments as they seek better returns than what their traditional assets can offer in the low-interest environment.

One way to do it is through the EFSI, or Juncker Plan, just like other investors have done. «Increasing private sector investment in infrastructure projects is a central aim of the EU Investment Plan,» says Cristina Mihai, head of prudential regulation and international affairs. «Therefore, while it is positive to see some improvements in the pipelines of infrastructure assets, more needs to be done to foster the supply and to crowd in private sector investors, such as insurers.»