Strade, ferrovie, porti, aeroporti, energia, telecomunicazioni, in una sola parola infrastrutture. Ogni anno nel mondo vengono investiti 2,5 trilioni di dollari per lo sviluppo di questi settori, ma non è ancora abbastanza.

L’ultimo report firmato dalla società di consulenza McKinsey analizza il gap finanziario nello sviluppo infrastrutturale necessario per colmare la domanda di crescita mondiale, e la cifra calcolata raggiunge i 3,3 trilioni di dollari, quindi 800 miliardi in più rispetto agli standard attuali.

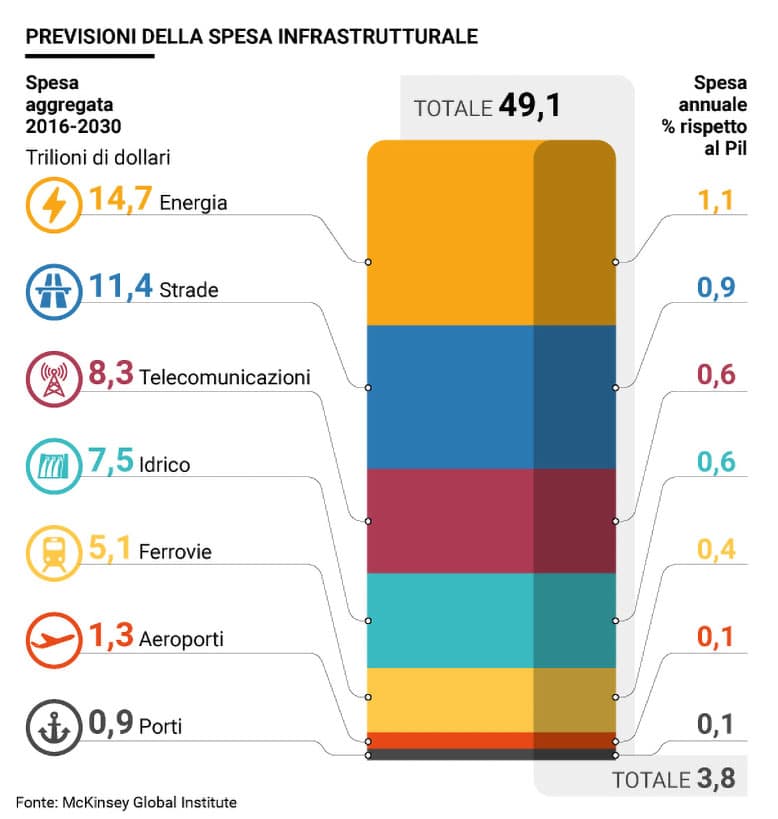

Un enorme investimento, necessario per il 60% del suo valore per sostenere lo sviluppo delle economie emergenti, e destinato in misura differente ai vari settori. La novità del Report, che nasce come un aggiornamento del Report del 2013 “Infrastructure productivity: How to save $ 1 trillion a year”, è infatti proprio nell’analisi di settore dalla quale emerge in che modo, da qui al 2030, sarà spartito tra i vari settori un ammontare totale di circa 49,1 trilioni di dollari.

Il settore che necessiterà di investimenti maggiori è quello energetico al quale dovrebbero essere destinati 14,7 trilioni di dollari. La manutenzione e la costruzione di nuove strade richiederà invece uno stanziamento di 11,4 trilioni; seguita dalle telecomunicazioni (8,3 trilioni), dal settore idrico (7,5 trilioni), dal trasporto ferroviario (5,1 trilioni), per finire con gli aeroporti (1,3 trilioni) e con i porti (0,9 trilioni).

Analizzando i dati in rapporto al Pil mondiale, l’1,1% della ricchezza prodotta dovrebbe essere destinata a finanziare il settore energetico; lo 0,9% per le strade; lo 0,6% per le reti di telecomunicazione e per l’idrico; lo 0,4% per le ferrovie e lo 0,1% per gli aeroporti e per i porti.

Mettendo insieme le varie voci – secondo McKinsey – il 3,8% del Pil mondiale dovrebbe essere utilizzato per sostenere sviluppo delle infrastrutture. A dispetto delle previsioni, la realtà rischia di prendere una direzione opposta e i numeri indicano una possibile contrazione degli investimenti nel settore infrastrutturale, almeno in 11 economie del G20.

Il calo degli investimenti apre la strada a fenomeni correlati che influenzano negativamente lo sviluppo economico dei Paesi. In particolare la mancanza di fondi da destinare al settore dei trasporti, così come a quello energetico, rischia di erodere tanto la produttività industriale quanto le potenzialità di crescita delle economie emergenti. Un tema centrale diventa quindi quello del reperiento delle risorse finanziarie che solo in alcuni casi possono essere coperte dagli Stati. La situazione sempre più critica delle finanze pubbliche, tanto nei Paesi sviluppati quanto in quelli in via di sviluppo, richiede che i privati svolgano un ruolo sempre più determinante nella ideazione e nella realizzazione di grandi progetti. Da qui l’importanza delle partnership pubblico-privato che – anche secondo gli analisti di McKinsey – rappresentano la strada da seguire soprattutto nei mega-progetti che altrimenti rimarrebbero sulla carta.

Inoltre il Report indica ulteriori strade già discusse, alternative alla raccolta dei fondi necessari per finanziare nuove infrastrutture, tra cui la vendita di alcuni asset degli Stati, così come l’aumento delle tariffe richieste a chi utilizza infrastrutture come ponti, autostrade o metropolitane.

L’analisi che la società di consulenza ha condotto negli ultimi anni dimostra anche che esistono margini di risparmio nei processi che portano alla costruzione e alla gestione delle grandi opere. In particolare è proprio dalla gestione degli asset infrastrutturali già esistenti che – secondo McKinsey – potrebbero arrivare risparmi pari al 40% rispetto ai loro costi di gestione attuali. Il tema è quello della produttività delle infrastrutture che ancora oggi, e nonostante i grandi passi in avanti compiuti negli ultimi anni, risulta lontana dai più elevati livelli di eccellenza e di efficienza.