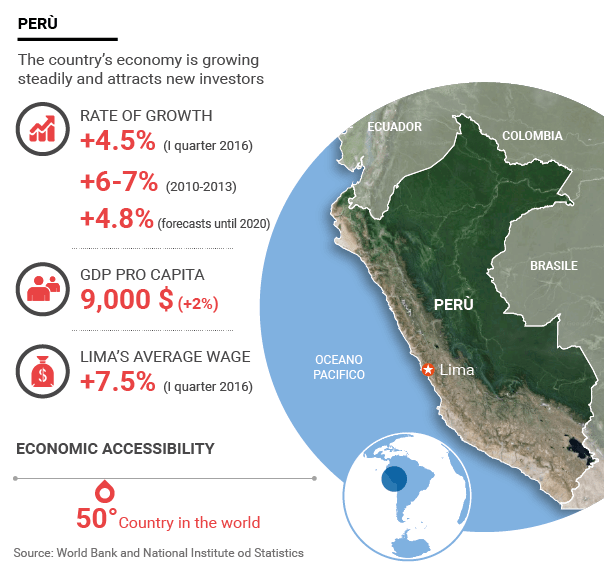

A 4.5% growth rate in the first quarter of 2016; a 2% rise in pro capita income from the previous year; stable inflation at about 3.3% for the last five years… Peru is considered by economists as the leading emerging market in Latin America.

It has had uninterrupted growth for the last 80 months with a forecast average rate of 4.8% until 2020, according to the World Bank. Lima is seeing its economically active population increase by 3.2% in the second quarter of 2016 after the average salary in the city went up 7.5% between January and April, according official statistics.

Beyond all these numbers, there is a dynamism in Peru’s capital that is almost palpable in light of the opportunities that it has to offer. From the port of Callao to the historic centre famous for its wooden balconies, the atmosphere is radically different from the 1990s and 2000s when the Shining Path and corruption were crippling democracy if not the state itself.

“El Milagro Peruano”

After a brief slowdown in 2014 (GDP at 2.4%), Peru has returned to its robust growth rates, confirming what economists have come to describe as “el milagro peruano”, or the Peruvian Miracle: steady development with an average growth rate ranging between 6% and 7%.

The order of the day has since become stability: the World Bank sees Peru’s economy growing faster than expected in the first half of 2016. For the third month in a row, the central bank has kept interest rates stable at 4.2% as inflation has remained subdued notwithstanding a relatively expansive monetary policy.

“Peru will have a leading role in the economic progress of all of the Pacific”, Alejandro Werner, director for the Western Hemisphere Department at the World Bank, recently said.

One of the engines of this “guiding role” is the growth seen in the food and mining sectors, which both grew by 10% in the first quarter of 2016 compared with the prior year thanks to the extraction of gold, silver and copper. But even construction is starting to grow. “Internal consumption of cement has risen by more than 3%, also thanks to a recovery in public investment in recent months,” explained Adrian Armas, head of research at the central bank.

The Role of Infrastructure

By the end of 2014, Peru’s government announced plans to invest $20 billion for five years to develop the country’s infrastructure.

Diverse sectors stand to benefit, ranging from railways to highways, water networks to energy. In this last sector, 23 projects based on renewable energy have been launched in the last two years. But the government’s investment will also concern public works like transportation, such as the Jorge Chavez International Airport, which is to have a new runway built beginning January 1, 2018 at a cost of $1 billion. Lima is obviously at the centre of this national development plan. Its nearly 15 million residents appear set to grow in number in the coming years. In addition to transport infrastructure such as the city’s new metro, Lima is witnessing the construction of schools, shopping centres, hotels, “viviendas” or residential buildings. In the cities and provinces new projects like Mall del Sur, Jockey Plaza and the Megaplaza are rising up.

This year the sector will grow 15%, and data from PMS Desarrollo Immobiliario show the commercial centre segment will repeat the 20% growth rate it registered in 2015. “Viviendas” and schools will not be far behind. This growth poses as a good opportunity for investors as well as makers of Italian products in manufacture, construction, food, furnisher and design.

Lima Metro

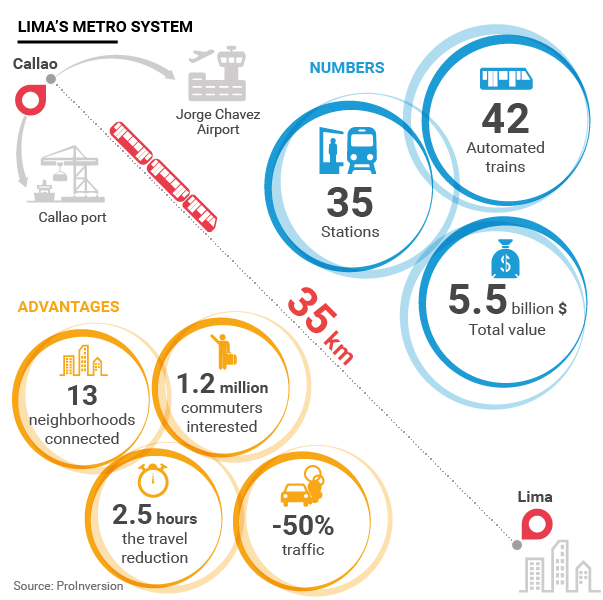

Among the big public works under way is Line 2 of the Lima metro system. Being by built by Salini Impregilo and other partners, the project is a line that will stretch 35 kilometres from the north-central region of the city to the coastal area of Callao, where the Jorge Chavez international airport and the biggest port in the country are located. The project also involves the construction of 35 stations and the supply of 42 automated trains for a total value of some $5.5 billion. Work will also be done on Line 4.

The project, which will connect 13 Lima neighborhoods, will reduce by 2.5 hours the travel time for more than 1.2 million commuters. It will also cut by half the cars clogging up the roads, helping reduce air pollution in one of the most congested cities in the world.

For its part, Lima is growing in social and economic terms. According to Anibal Sanchez, who heads the official statistics institute, average per capita income rose 4.8% in 2015, while between January to April of 2016 it went up by another 5% compared with the same period last year.

Women and young people gained the most from this increase, with their incomes growing 7.5% and 9%, respectively, followed by the people 45 and older with income growing 5.7% and those over 25 at 4% during the same January-April period.

The Future of the Country

Projects like these confirm the interest of multinational financial institutions in a market of great potential such as Peru.

In 2016, the World Bank approved six projects for the social and infrastructure development of the country for nearly $3 billion. For the moment, the World Bank has 24 projects open in Peru, while the Inter-American Development Bank has $2.3 billion made out in loans, of which $985 million to strengthen the transport sector, $330 million for social inclusion, $242 million for energy production and $111 million for public administration reform. There are 23 projects open thanks to resources from the IADB.

The rating that the World Bank gives Peru in its Doing Business report for economic accessibility is 71.3 on 100, 50th out of 189 countries. After Mexico and Chile, it is the third country in Latin America in terms of ease of doing business.