Some people are already dreaming about a new Mexican revolution. Andrés Manuel Lòpez Obrador’s election as Mexico’s president has rekindled hope in a country brought to its knees by corruption and its never-ending drug wars. The new leader – along with a nationalist spirit and the promise to emancipate the poorest part of the population –made pragmatism a key feature of his campaign, insisting on the importance of relaunching Mexico’s economy. To achieve this goal, Obrador has repeated time and time again, the government needs to increase infrastructure spending to modernize the sector and create jobs. This spending is something the country absolutely needs, as shown by statistics published in the G20’s Global Infrastructure Hub: Mexico’s gap between the trendline of the amount it invests in infrastructure and the amount it should spend is $544 billion.

The President’s Programme

Born in 1953, Obrador, the former mayor of Mexico City best known by his initials AMLO, is betting part of his political capital on infrastructure. His electoral programme calIed for doubling spending on large projects, seen as an important stimulus for the country’s economic growth. More specifically, Obrador pledged to spend the equivalent of 4.1% of the country’s gross domestic product on infrastructure and social programmes.

He also plans to discontinue gargantuan projects with sky-high price tags in order to spread resources across a greater number of projects, especially in transport. For example, he wants to abandon the ambitious $13-billion Nuevo Aeropuerto International de México airport project that would have a capacity of 140 million passengers each year. In fact, one of his first actions after the election was to call for an audit on the project for Mexico City. The new government’s designated Infrastructure Minister Javier Jiménez Espriù told the local newspaper “Milenio” that the audit involves both the costs and the project’s technical characteristics.

«If [the results of the audits show] the project is okay, we will accept it», he said. «But we believe that there are other options that are better suited to the country’s conditions, which are less costly and quicker to develop».

The most probable option, according to Obrador’s campaign announcements, is to modernise the two existing airports (the military airport of Santa Lucia and the Benito Juarez International Airport). This option is less costly and can be completed in just three years.

Fighting corruption in the construction sector

The fight against corruption is another part of efforts to bolster the development of the construction sector. Speaking earlier this year at the CMIC national construction congress in the state of Jalisco, Obrador reiterated his goal of making the public tender process more transparent in order to eliminate the corruption that had been so prevalent in this sector.

The Organisation for Economic Co-operation and Development (OECD) also has this issue on its radar screen. In a recent report, Jacobo García, Senior Specialist on Integrity and Procurement Policies at the OECD, said: «There needs to be more incentives to be more transparent and ethical. Companies that follow these actions should be awarded more points. We must work on enforcement and create a culture of integrity throughout the industry».

This position was reiterated recently by Alejandro Ruiz, Head of Construction at KPMG Mexico. «Apart from reinforcing PPPs and making them more attractive, transparent and ensuring financial security, a fiscal reform is necessary to acquire the funds to bridge the country’s infrastructure gap», he said. However, if the projects that got started last year are completed in the next few months, revenue for 2018 could grow between 1% and 3%, KPMG said. But if that does not happen, the risk is that the sector will continue to shrink this year.

Infrastructure: a sector with patchy growth

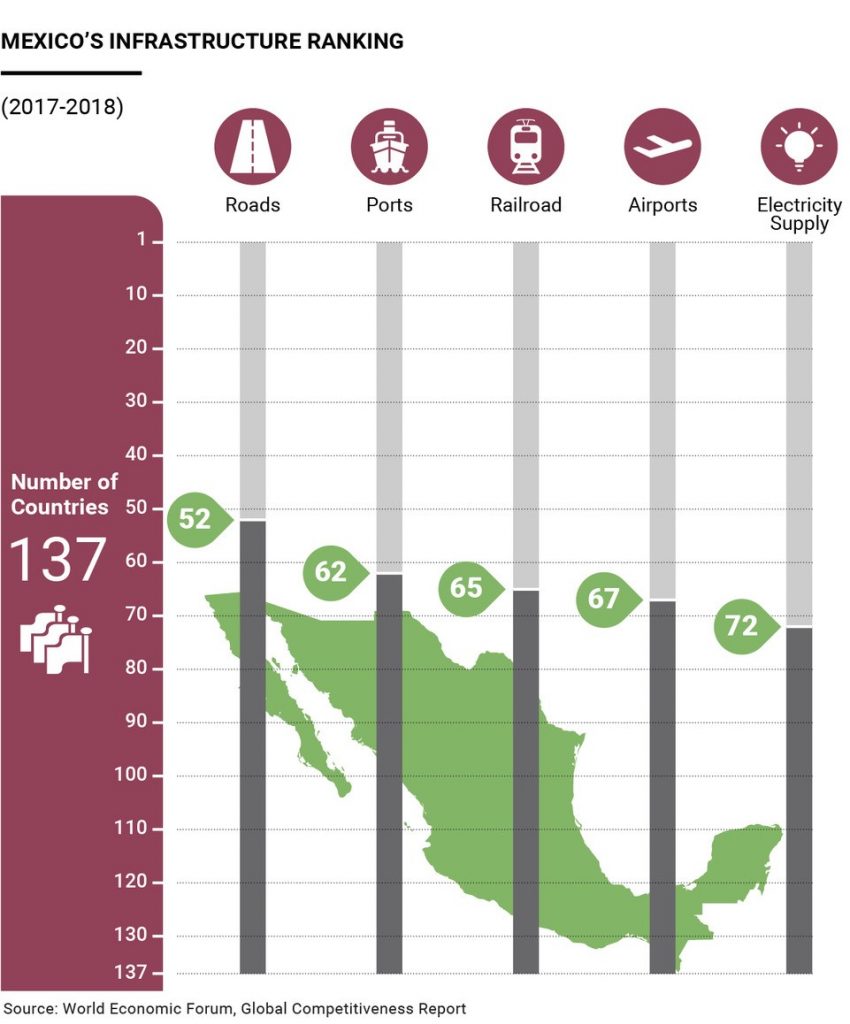

The relationship between Mexico and public spending on infrastructure is patchy. On the positive side, “Forbes Mexico” reported recently that the outgoing government completed 85% of the infrastructure plan launched in the last legislature, including 80 roads and 50 highways. The maritime sector has seen good growth, with overall capacity in ports increasing since 2012.

Despite these bright spots, the main problem remains a low level of spending. For most of 2017, investment fell 34% from a year earlier. The part of the sector suffering the most was water, particularly the treatment of potable water and sewage, where the drop in investment reached 51%.

This lack of financing is the construction sector’s biggest problem, and makes it nearly impossible to achieve the dream of bridging an infrastructure spending gap of $544 billion. A huge sum for a country like Mexico, which is hoping that its new president can achieve a miracle.