In the light of the erosion of public resources and the growing burden of public debt, the role of private investors in helping governments launch public works projects has grown in importance. This role comes in the form of a partnership. Known as a Public-Private Partnership, or PPP, it brings the two parties together to work on a specific project, which in most cases involves the construction of some sort of infrastructure.

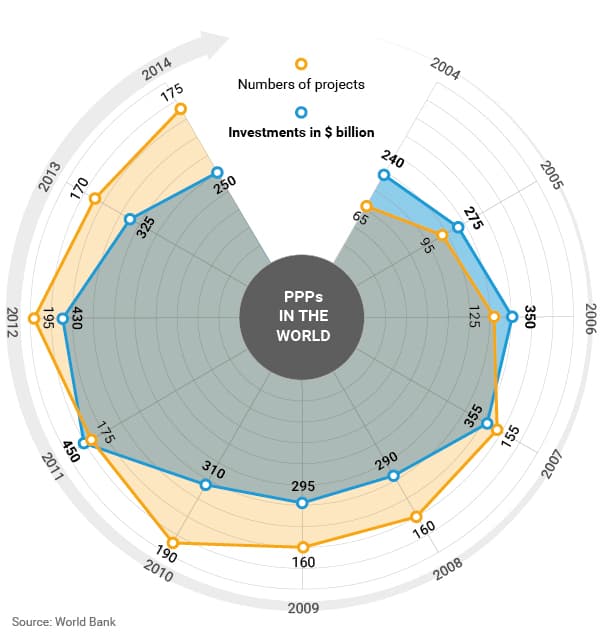

PPP has become a phenomenon. From 2004 to 2014, the combined value of projects being done by means of PPPs increased from $65 billion to $175 billion, according to the World Bank. Figures for 2015, the latest available, show how PPPs were behind 600 projects for a combined value of $350 billion, according to Prequin, a consulting firm.

Whether it be the construction of a hydroelectric plant, a railway line, a bridge or a hospital, PPPs help public entities to raise additional funds from the private sector to launch infrastructure projects and organize socio-economic development programmes. This is done in two ways. The first sees the public and private partners in a project sign a contract stipulating the rules and responsibilities of both, while the second leads to the creation of a company in which both are shareholders. The investment made by the private party is usually repaid by means of a concession to run the project for a set period of time after its construction. In the case of a bridge or a metro line, for example, the private party that took part in its construction by providing financial backing can collect tolls from users of the finished structure for a determined number of years.

The arrangement appears to work: seven out of 10 investors that have taken part in one project or another have said the performance registered during the past year had been better than expected, with 52% of them intending to dedicate more resources to this type of endeavor for the long term.

Public-private partnership: Infrastructure for Growth

Big infrastructure projects are at the core of PPPs because they have a big impact on the development of a local economy and can attract a lot of interest from private investors. In 2015, the most expensive project to be financed by a PPP was Hinkley Point C, the nuclear power station in Somerset, England. Its cost is estimated at $18 billion.

Projects developed by PPPs tend to fall in one of three categories: water, transport or energy, even those in ranges from technological innovation to telecommunications to health waste management and social inclusion.

In the first six months of 2015, the value of projects in these three categories reached a combined $25 billion, according to the World Bank. They include roads in India, China, Russia, Peru, Guatemala and Brazil; airports in Turkey, Colombia and the Philippines; ports and canals in India, Mexico and Panama; electricity grids in southeast Asia and South America; telecommunications systems in the Middle East and South America.

Although many governments get financing from the World Bank to the European Investment Bank, private investors such as investment funds are becoming more involved. Last year, the International Finance Corporation of the World Bank alone was involved in 59 projects with private investors. The number of projects to be financed in emerging economies is expected to grow in 2016, reaching 179 for a combined value of $120 billion.

PPPs in the World: public-private partnership infrastructure projects

But the success of public-private partnerships goes beyond developing countries. Even developed ones are resorting to PPPs to help share the financial burden of building public works. Australia was one of the first countries to resort to a PPP.

The Victoria Partnership (named after the state of the same name) has done 24 PPPs for a combined value of AU$12.4 billion. Among them is the supply of 65 high-capacity trains for the Cranbourne-Pakenham line in Melbourne.

In China, the futuristic city of Shantou in Guangdong province was entirely financed by PPP. In the United States, the West Coast Infrastructure Exchange was created in 2012 by the governments of the U.S. states of California, Oregon and Washington and the Canadian province of British Columbia to attract private investors to infrastructure projects.

At its latest forum, the United Nations Economic Commission for Europe (UNECE) confirmed the fundamental role of the PPP in helping reach the objectives of the Agenda 2030 for Sustainable Development. It also emphasized its social importance as regards sustainable global growth. “(The) PPP model can transform and improve the quality of life of socially and economically vulnerable people,” reads it conclusions.

UNECE cited many successful cases. Russia improved water supply in an area where the value of property rose as a consequence; Brazil’s “Luz para Todos” project has brought electricity to poor neighborhoods known as favelas; while farmers, land owners and the government in Haiti are working on improving crops and living standards in rural areas.

“This vision of a PPP model which improves people’s lives, alleviates poverty and promotes a better planet (is) indeed how the PPP model should be developed and mainstreamed into development financing in the future,” continued UNECE.