Lean, clean and green: this is the motto of the Asian Infrastructure Investment Bank (AIIB), the financial institution founded to support development in Asia that opened its doors in January after a long preparatory phase begun two years earlier.

In the spirit of this motto (small, efficient and skilled staff; maximum transparency to avoid corruption; respect for the environment), the boards of governors and directors held their respective meetings for the first time on Jan. 16-17. The two boards bring around the table representatives of the bank’s 57 founding members and 27 other countries that are preparing to join.

The AIIB has come into being with the ambitious goal of filling the huge gap in infrastructure investment in the region, which is growing at a strong clip despite the market turbulence of recent months. Statistics from all the major international financial institutions highlight the need for a strong injection of financial resources to quench the thirst for infrastructure in the region. The Asian Development Bank and the World Bank guarantee only a combined $20 billion a year, which is too small a figure to meet the needs of countries like China, Malaysia and Indonesia, all of which are experiencing strong growth. A report by the Asian Development Bank estimates that the region will need about $8 trillion to respond to its infrastructure needs in the next five years. In the case of Indonesia, $230 billion are needed. Meanwhile, $50 billion are required for new infrastructure in the Mekong region, which includes parts of Vietnam, Laos, Cambodia and Thailand. In all of this, China is playing a decisive role, with the Organisation for Economic Development and Co-Operation (OECD) saying the construction sector in the country will grow by 7-8% a year until 2020.

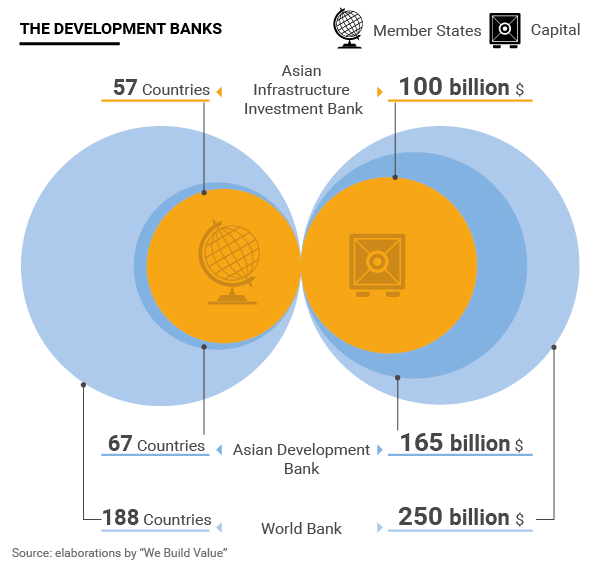

So there is a sense that his new institution is destined to alter the balance among the bodies involved in financing development. Up until recently, the international scene was almost entirely dominated by the World Bank and the International Monetary Fund on the part of the West and the Asian Development Bank on that of Asia. The latter was formed in 1966 after a strong push by the United States and Japan, which still hold about 30% of it. The AIIB, meanwhile, was born out of Beijing’s initiative.

To emphasize the point, non-Asian member countries cannot hold more than 25% of the bank’s capital. This limit has not stopped Western countries from signing up, however. In addition to Italy, other founding members include the United Kingdom, Germany, France, Spain and Switzerland. In addition to many Asian countries, there are those from the Middle East like Qatar that have taken significant stakes.

What brings all these international investors together are clear programs that concern exclusively infrastructure, whether it be transportation, energy, telecommunications, agriculture, urban development or industry in general. And this marks another difference between the AIIB and the role of the World Bank and the Asian Development Bank, whose joint aim is to reduce poverty. The AIIB’s role was recently explained by its president, Jin Liqun. «Investment in infrastructure, solid and sustainable, will bring superior development results to improve the quality of life and the economic capacity of Asian citizens, generating a positive effect elsewhere in the world», he said. The president’s words are the point of arrival after a journey that officially began on Oct. 24, 2014 with the bank’s inaugural ceremony. This formal inauguration only became operational these last few weeks when the bank began discussing the allocation of the first investments of its $100 billion budget. International observers, member countries and industrial players are waiting to see where these monies will end up, which projects will be financed and which countries will get them first. Meanwhile, the infrastructure market is growing at rates that are much greater than the world’s gross domestic product, confirming that the multiplier effect of these investments can be just as enormous as the direct benefits of the communities that receive them.