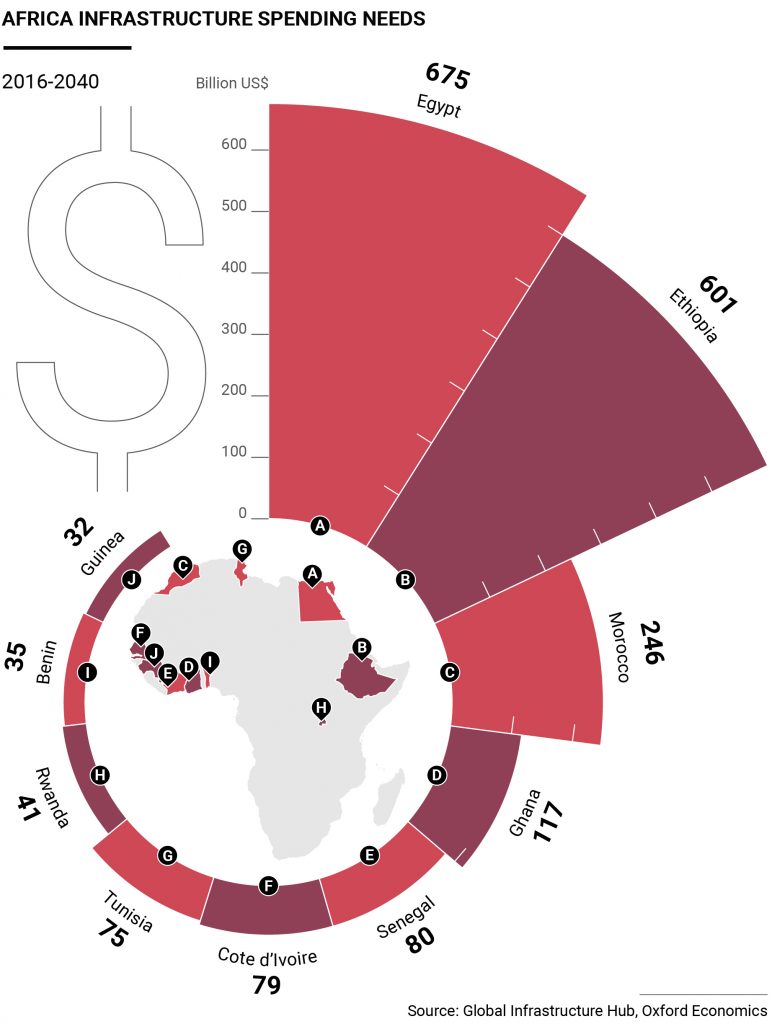

A group of 10 African countries including Egypt, Ethiopia, Morocco and Senegal need to raise an additional $1 trillion for infrastructure investment if they are to meet the goals of sustainable development set by the United Nations for 2040 like access to clean water and sanitation, according to a new report.

The amount is nearly double the $1.4 trillion that they are expected to channel into projects like roads, railways and other crucial infrastructure during the period, according to the report published in early July by the Global Infrastructure Hub. Based in Sydney, Australia, the hub is an organization set up by member countries of the Group of 20 (G20) to promote private investment in the sector. Compact with Africa (CWA) is a hub initiative to encourage private investors to consider projects on the continent where population and economic growth rates are among the highest in the world. The hub has developed a database on Africa, and the latest report, done in coordination Oxford Economics, marks the inclusion of more countries to it, such as Benin, Cote D’Ivoire, Ghana, Guinea, Rwanda and Tunisia.

Entitled “Global Infrastructure Outlook: Infrastructure Investment Need in the Compact with Africa Countries”, the report comes two months after the publication of another one done with consulting firm KPMG in which the hub speaks of the need for good governance to increase the number of private investors entering the market.

The hub’s chief executive, Chris Heathcote, told the Reuters news agency at the time of the release of the latest report that investors were becoming more interested in Africa in light of the need for more infrastructure in all its forms. “Africa is a fascinating continent for investors,” he said. “They’re not saying ‘Am I going to Africa?’. They’re saying ‘I am going to Africa. I want to go to Africa. Which country should I go to?’”

Africa’s need for infrastructure highlights how much the continent is behind in meeting the 17 Sustainable Development Goals set by the United Nations for 2030. In addition to clean water and sanitation, they include affordable and clean energy, and sustainable cities and communities. In the report’s introductory remarks, Heathcote says only 60% of residents of countries surveyed under the CWA initiative have access to electricity, while 44% have it for water. He cites these goals because electricity and water are among the most urgent needs among the 10 countries surveyed.

“We find that for the 10 CWA countries to meet the goals for universal access to electricity, water and sanitation, it would cost US $621 billion between 2016 and 2030,” reads the report. “Three-quarters of this figure relates to electricity, and one-quarter to water and sanitation.”

The UN’s Goals, which came into effect in 2016, are a call to action to end poverty across the globe.

The total spending requirements for the 10 countries under review are dominated by Egypt and Ethiopia, which each account for more than 30% of the CWA total under both the current trends and relative investment need scenarios, according to the report. Ethiopia, for one, is spending massive amounts on the construction of hydroelectric dams to become an energy hub for the region.

As for the gap between what is spent and what is needed, the report says it is widest in the case of Guinea among the 10 countries. “The investment need forecast is more than 80 percent greater than what would be spent under current trends,” it says.

“The question for many investors is… which countries in the continent will be most likely to stand behind the sort of long–term contracts investors are interested in, and have the economic plan to create and maintain the stability they require,” it says.

As the benefits that come from private investment start to show, other countries will want to follow suit with reforms of their own.

The report cites good governance, capable institutions and consistent regulatory frameworks are the necessary ingredients to attract private investors.