Shanghai and Singapore, Dubai and Los Angeles, Busan and Hamburg: the heart of the global maritime trade is represented by big ports, these giant facilities and logistical centres capable of responding to the trend towards gigantism among shipbuilders and to the growth in trade itself.

This means massive investments, tens if not hundreds of billions of dollars earmarked around the world to modernize structures that are becoming bigger and, above all, faster and more efficient in handling cargo.

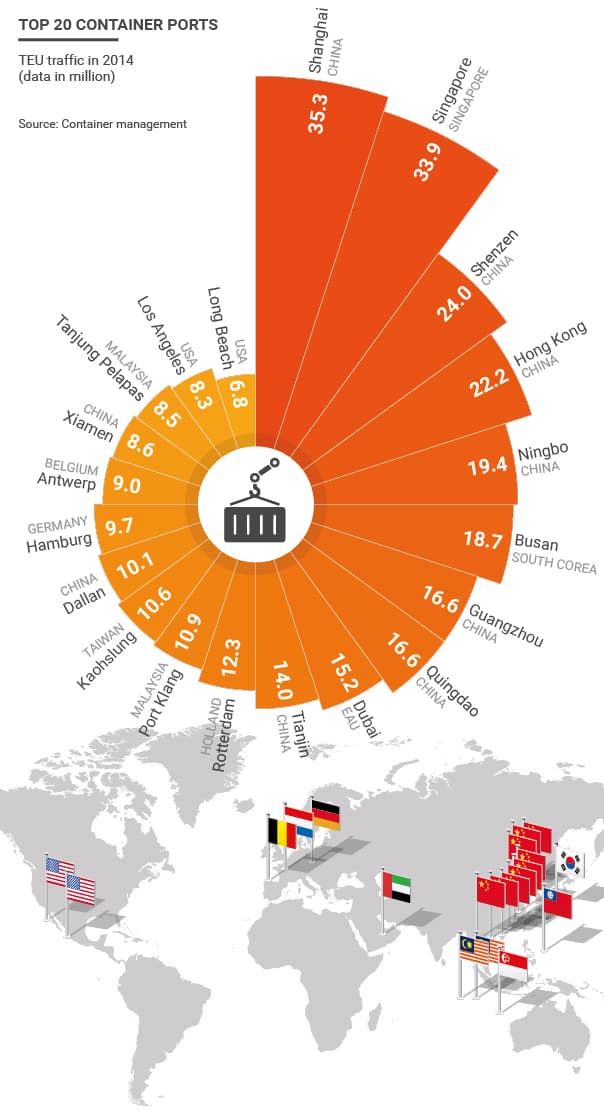

Apart from Singapore (which ranks second among global ports), China monopolizes the top five positions, beginning with Shanghai, which receives the greatest amount of traffic in terms of tonnage. China and the United States share 30% of the 120 most important ports in the world, followed by Europe, where Rotterdam in the Netherlands ranks first in the region but 11th in the world, according to industry magazine, “Container Management”.

The rise in traffic at ports and the subsequent development of their facilities are indicative of the world’s growing economy and maritime trade as well as the increased the number of international shipping routes.

Panama and Competition among Shipbuilders

In the perpetual contest between host and hosted, the fast pace at which the shipbuilding industry is running forces ports to keep up.

The latest cargo ship to come out of the shipyard, for example, has set a record in size. The “Triple E” (economy, energy efficient and environmentally improved) is capable of transporting up to 18,000 containers – so many that if they were loaded onto a train one after the other, the wagons would stretch along the railway for 110 kilometres. So big are these ships that ports are unable to receive them. As of today, the “Triple E” only passes through the Suez Canal that links China with Europe. As for ports in Europe, the one that is best prepared to receive it is Southampton in the United Kingdom. Antwerp in Belgium, meanwhile, has plans to invest in its facilities in order to be able to accommodate them.

But apart from these giants of the sea, maritime trade is changing in a profound way also in North and South America. The expansion of the Panama Canal (built by an international consortium led by Salini Impregilo) represents a great instigator of development because, as of this summer, the new Canal will be able to receive Post-Panamax ships that carry up to 14,000 containers. In the world’s shipyards, there are 450 of this type under construction and ports in the Americas are preparing themselves to receive them. Miami, New York, and Norfolk in the United States have launched development plans while those in Central America and the Caribbean are adopting similar measures such as Mariel in Cuba and Kingston, Jamaica. Panama’s two commercial ports – Colon and Balboa – are obviously following suit. They each handle an average of three million containers a year.

The Contest between Singapore and China

In recent years the contest for top spot among commercial ports has been waged between Singapore and Shanghai. The city state and China consider maritime trade a strategic part of their development, as shown in the massive amounts of money that they are investing to increase the capacity and efficiency of their respective ports.

Since 2010, the title has been held by Shanghai. The latest annual figures show a traffic equal to 35.3 million TEU (twenty-foot equivalent unit) in 2014, 4% more than the previous year. It is a growth that takes into account sustainable development and the adoption of “green” technology to reduce any impact that its operations might have on the environment.

In 2014, the port authority of Shanghai signed an agreement with its counterpart in Los Angeles for a so-called eco-partnership to exchange information, technical expertise and best practices on the sustainability of their ports. Los Angeles is considered to be one of the more sensitive U.S. ports to the environment in addition to being the largest port in the United States with 830,000 jobs.

Shanghai’s exponential growth and its focus on best practice has increased competition with Singapore, which ranks second among the world’s ports, having moved 33.8 million TEU in 2014. The prime minister of the city state, Lee Hsien Loong, has announced plans to invest $8 billion to develop the port’s facilities even more. According to government estimates, the first phase of the expansion could be completed by 2022, allowing the port to handle 65 million containers a year. But the contest is still on because Shanghai will surely no sit on the sidelines.

The Middle East Match

Located near the Suez Canal in a strategic position along the routes that link Asia with Europe, the Arabian Peninsula is investing a lot in its ports. Their development plans are intrinsically linked to the construction of modern cities in Saudi Arabia and the United Arab Emirates.

In Saudi Arabia, $30 billion in ports has been invested in recent years. By 2020, another $100 billion is expected for transport and logistics networks for maritime trade. The country’s focus is on the Jeddah Islamic Port, which is at the centre of this expansion drive that aims to increase traffic capacity by 45%. The country aims to draw business from the 25,000 mercantile ships that every year pass from south to north through the Red Sea to the Suez Canal, something that is destined to grow in the future. Dubai is also jockeying for position. DP World is a huge port operator controlled by the Emirates with 65 terminals on five continents including India, Africa, Europe and the Middle East.

With more than $3 billion in revenue and 30,000 employees, the group in January entered a partnership with the Russian fund Direct Investment for the develop of ports and infrastructure in Russia. DP World Russia is ready to invest more than $2 billion to this end.

Africa’s Response

Even the African continent, despite the economic difficulties and political instability of many countries, is living a period of port development.

Among the most significant projects are Lamu in Kenya where an investment of more than $4 Billion is expected, and Bagamoyo in Tanzania north of Dar es Salaam where the cost is expected to reach $10 billion. And then there is Djibouti.

Abubaker Omare Hai, the port authority’s chairman, recently announced a development plan that foresees $9 billion to be spent in next three years. The idea is to take advantage of the port’s location at the centre of one of the most trafficked routes in the world that links eastern Africa with Asia and is used every day by 90 ships. To take advantage of this strategic position, the country is ready to build six new ports, of which four – Tadjoura, Ghoubbet, Doraleh e Damerjog – are already under construction. Once completed, the plan would be to offer to world trade a new logistics platform to challenge ports on the Atlantic.

Even in North Africa, the ports of the countries on the Mediterranean have traditionally played an important development role with ties to Europe. Homs is a case in point. Built between 1980 and 1984 by Salini Impregilo, it soon became a key point of exchange among Mediterranean countries, becoming one of the most trafficked in Libya. But its future, as is the case for other ports along the coast, is threatened by the political instability that has engulfed the region. Only when the geopolitical balance in the region has been re-established will these ports be able to function normally.