For the years leading up to 2030, the global market for big infrastructure projects promises two important trends: the first is a sector growth rate that will be greater than that of the world’s gross domestic product (GDP); the second is that those that will spur this growth will mainly by three countries: China, India and the United States.

This forecast was made by Oxford Economics and Global Construction Perspectives in Global Construction 2030, their latest collaborative Report that looks at the market trends in construction over the long term.

According to the Report, which was presented in London in November, the next 15 years should see the volume of construction output grow by 58% globally, arriving at $15.5 trillion by 2030. This surge will be thanks to these three countries, which will together comprise 57% of the total growth.

United States, China and India

If it is true that annual average global construction growth from now to 2030 will be 3.9% (a percentage point more than global GDP), it is also true that a large part of this will be due to growth in these three countries.

The United States is the most significant, according to the Report, which sees it growing more than China at an annual rate of 5%. So this leads to a comparison between China and India. With the slowing of its economy, China is gradually changing its economic model. After years of internal investment in the construction sector and big infrastructure, the economy is starting to shift towards retail and services. The three golden years between 2010 and 2012 that witnessed China producing more cement than the United States between 1900 and 2013 belongs to the past.

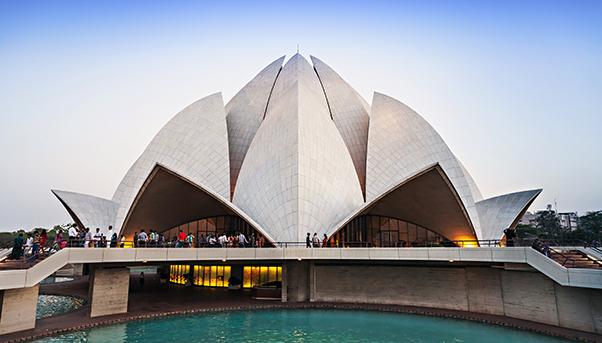

The present – and especially the future – sees China growing at slower pace. This will allow India to surpass it in terms of the vitality of its own construction market. The country is undergoing a golden era of construction and – as explains Graham Robinson, executive director of Global Construction Perspectives in a statement about the – “it overtakes Japan to become the world’s third largest construction market by 2021.”

Once it has left Japan behind, India will continue on its course and in the next 15 years its construction market will be growing at a quick rate – at least double that of China’s. This boost would appear to be a natural reaction to the demographic boom that India is experiencing. By 2030, India’s urban population should grow by 165 million people, turning Delhi into the second biggest city in the world.

The Race Inside Europe

Europe’s construction market will have to wait until 2025 before it reaches its pre-crisis levels. This has to do with a gradual move that follows the general economy, which is destined to grow slowly for a long time. According to the Report, even the quantitative easing measures adopted by the European Central Bank to pump liquidity into the market and devalue the euro against the dollar will not bring significant changes in the long run.

So the race is being waged not with a big international competitor but inside the continent itself where the United Kingdom is set to distinguish itself in the coming years as the infrastructure market with the most decisive growth rates, overtaking Germany and becoming by 2030 the biggest in Europe and the world’s sixth largest construction market.

As for France, Spain and Italy, the situation is different and more critical. France has the problem of weak internal demand that is slowing down investment, while Spain and Italy are slowly recovering from the crisis. Spain is doing better because its construction market should grow by an annual average of 3% in the next five years, while Italy will do only half of that rate at 1.5%.

The Middle East

The big push to build in the Middle East, led by megaprojects launched by Saudi Arabia, Qatar and the United Arab Emirates, risks slowing down because of low oil prices. Saudi Arabia’s current policy and, more generally, that of the Organization of the Petroleum Exporting Countries (OPEC) to squeeze out small shale producers elsewhere in the world has meant that they have had to rely on their vast cash reserves. But they will not be able to sustain this strategy for too long. If the price of oil remains low, this will have an impact on the fiscal budgets of Saudi Arabia and other Gulf states.

One counteracting force in the construction sector is the preparation for the 2022 World Cup in Qatar. This remains a beacon of growth and opportunity for public works.

Sub-Saharan Africa

In the coming years, the average GDP of 45 countries that make up Sub-Saharan Africa should keep growing at sustained rates (about 5.1% a year), which the World Bank says is favored by investments in infrastructure. The risk for the region is a drop in foreign investment that in recent years have fed public works, but this might not start before 2025.

The Global Construction Report identifies Nigeria as the most interesting country in terms of infrastructure growth. Its government has embarked on a series of reforms to liberalize the oil industry and attract new investors. What’s more, Nigeria’s demographics are exploding. By 2030, it will be one of the populated countries in the world with a resulting increase in the number of people of working age. That will give an extra boost to the economy.

Emerging Economies

There are diverging trends among emerging economies, even between neighboring countries. “We see significant weakness in Brazil and Russia, whilst we see extraordinary growth in Indonesia. In Latin America, we expect Mexico to overtake Brazil, whilst Indonesia will overtake Japan by 2030,” says Jeremy Leonard, director of industry services at Oxford Economics in the statement.

In South America, the situation in Brazil is set to worsen. From now to 2030, the construction market is expected to grow at very low rates (less than 1% a year). This is because of the risk of recession, the stranglehold of excessive bureaucracy and the Petrobras scandal. The strong demographics that had supported Brazil’s growth are weakening, leading to stagnation in construction for the long term. Despite the funds set aside for the World Cup and the upcoming Olympic Games, investments have diminished in the last 18 months and this, according to the Report, will hurt the construction industry for the next two years.

The same for Russia. This year, the economy should contract by 4% with a negative effect on construction. Spending on new infrastructure should drop in 2016, returning to grow at a weak rate in 2017.