Investment in the U.S. transport sector is seen rising in 2017 by 1.3%, a rate that is so modest that it is unlikely to reverse the decline into a state of disrepair of the country’s roads, bridges, ports and other parts of crucial infrastructure.

President Donald Trump’s administration is working on reforms as well as an investment plan to address this urgent problem. But it will take a long time before the necessary funds begin to arrive even if a group of senators of the opposition Democratic Party have shown a willingness to work with Trump on the matter, producing their own plan on where to invest.

Meanwhile, the American Road & Transportation Builders Association (ARTBA) expects investments in the transport sector to increase by 1.3% to $247.8 billion this year, driven mostly by private construction of bridges and highways for residential and commercial developments. By comparison, construction and support of public highways and bridges are the only two activities in ARTBA’s forecast that are expected to show less activity this year.

The funding gap for the transport sector is nevertheless huge. One reason is that federal funding program levels remain modest, given the delay in the disbursement of funds despite the passing of the Fixing America’s Surface Transportation (FAST) Act by the previous administration in December 2015.

So poor is the state of things within the sector that the latest report card by the American Society of Civil Engineers (ASCE) gives roads a D and bridges a C+ – both unchanged from the previous report card.

Roads are not only in poor condition but also have difficulty handling traffic, which has grown over the years. ASCE says 32% of them are in a mediocre state, needing $67 billion for maintenance. As for highways, 47% are congested with traffic, costing drivers $101 billion in extra fuel and 39 hours in lost time every year. These open plenty of opportunities for investors and builders alike.

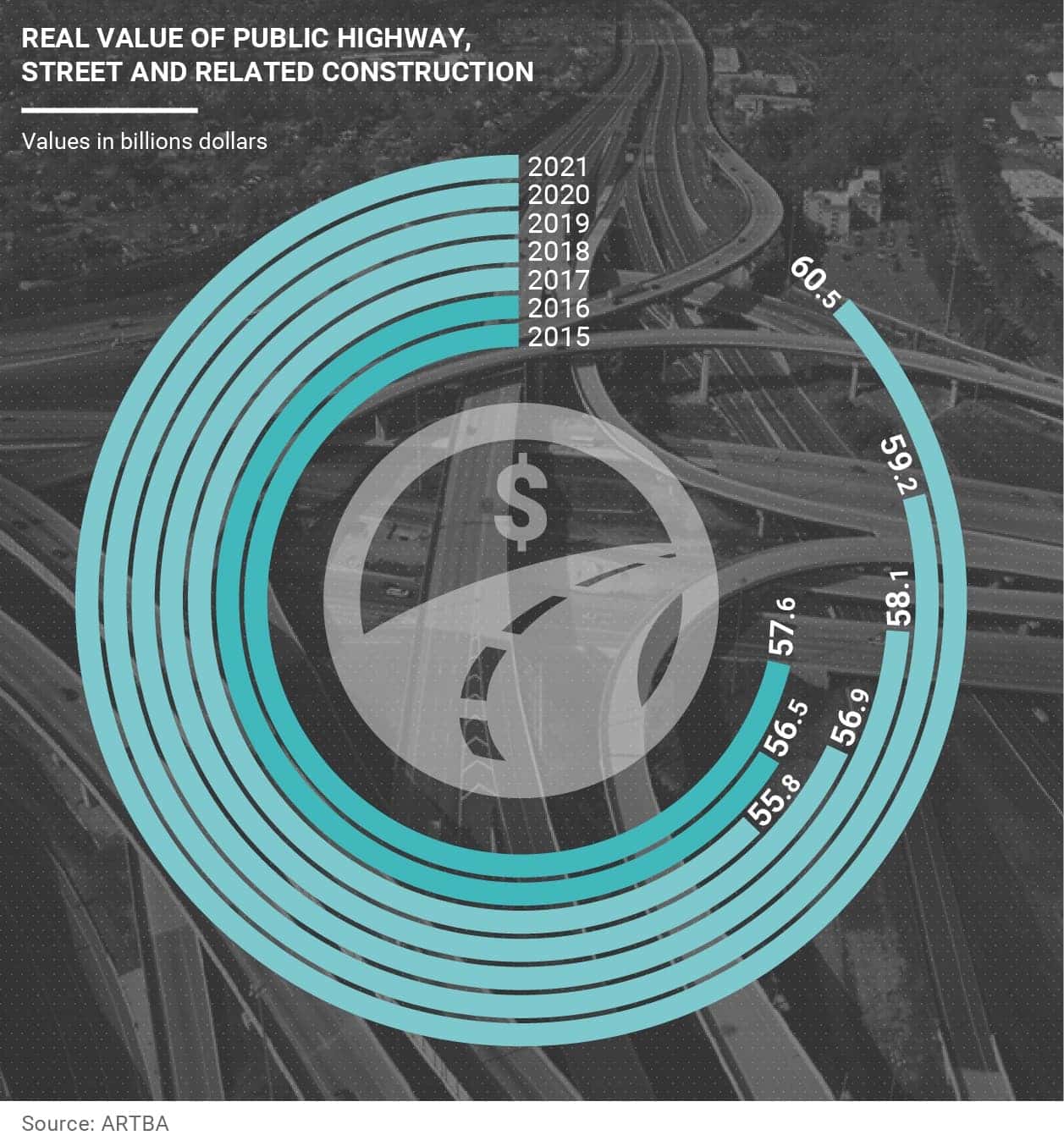

Construction of public highways and bridges – the biggest of six categories identified by ARTBA – is seen getting $88.7 billion this year against $89.9 billion in 2016. Of this total, highway, street and related work will get $55.8 billion compared with $56.5 billion. Tunnels and bridges are also in a sorry state. The average age of a bridge is 42 years, while one out of every nine bridges is deemed structurally deficient, according to ASCE.

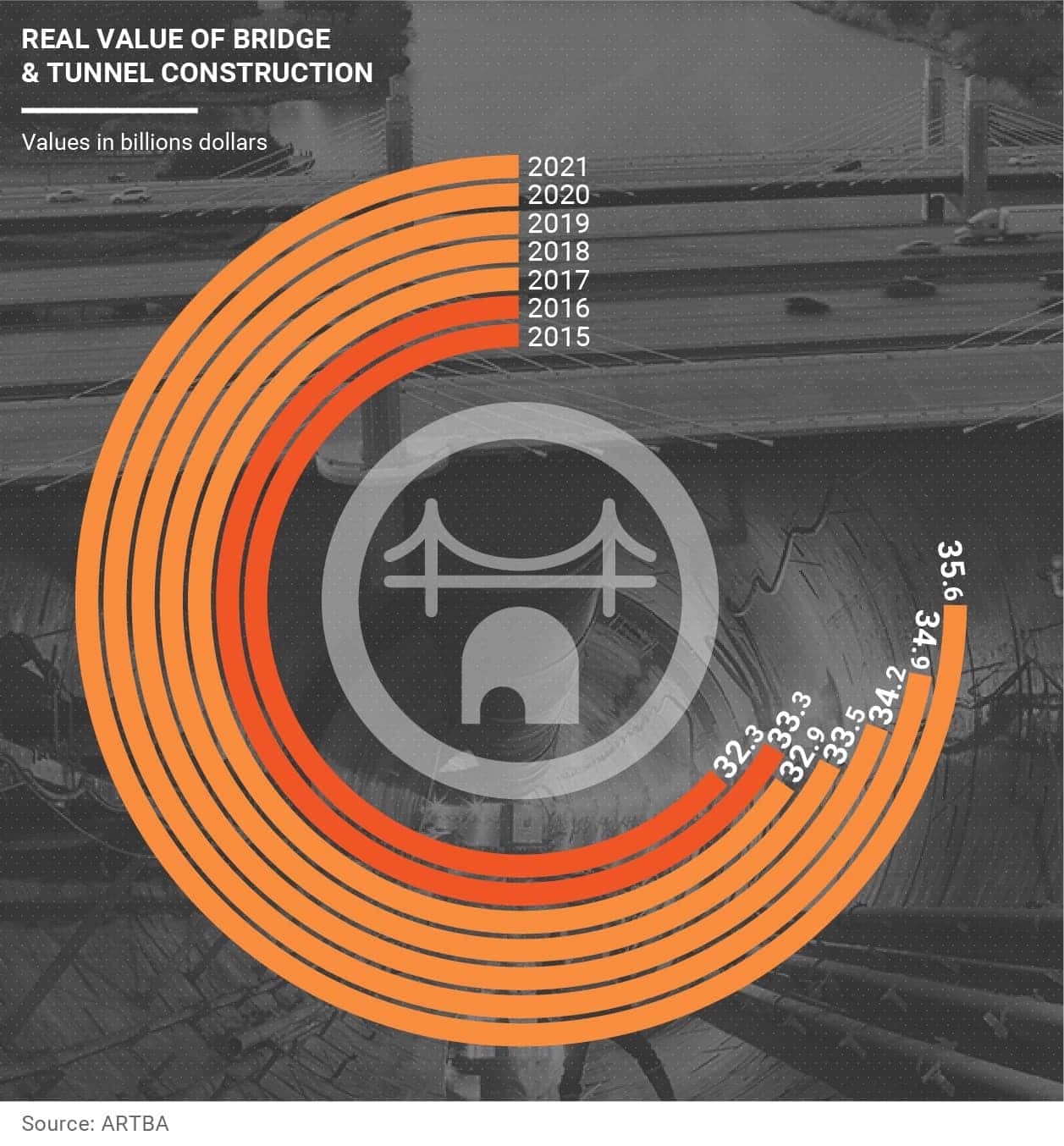

Tunnels and bridges are seen by ARTBA as suffering a decline in activity to $32.9 billion from $33.3 billion in 2016. But it should pick up by 2021, reaching $35.6 billion.

«Although the FAST Act provides market stability for state DOTs (Departments of Transport), the modest funding increases are not enough to drive significant, real market growth across the country,» ARTBA says of public and private streets, highways and related construction. «Therefore, it is up to state and local governments to provide new resources to grow investment.»

Just last year, voters in 24 states approved ballot measures to support $207 billion of spending on highways, bridges, ports and other infrastructure for the next 40 years.

Public-private partnerships (PPP), another way to raise the money needed for projects, saw more than $3.3 billion worth of investment close last year for five projects including Arizona and Virginia.